This is article five in the Educational Business Series (EBS).

Introduction

Titman et al. (2019) broadly define finance as “the study of how people and businesses evaluate investments and raise capital to fund them” (p. 36).

A more descriptive response would be to view finance as a subject of managing, allocating, and utilizing monetary resources which involves acquiring, investing, and managing money to maximize value and achieve financial objectives. It also includes assessing the “time value of money, risk and return, diversification, and financial markets” which include financial instruments (e.g. stocks, bonds, and derivatives) as well as integrating “tools like financial analysis, forecasting, and valuation to guide decision-making” (xAI, Grok 4, 2025).

Accounting topics commonly align with one or more of the three accounting classes: financial accounting; managerial accounting; and financial management.

Financial accounting addresses the recording and reporting of financial transactions and the preparation of financial statements (e.g., income statement, balance sheet, cash flow statement, etc.) for the benefit of an entity and external stakeholders such as investors, creditors, regulators, and tax authorities. It adheres to standardized frameworks such as Generally Accepted Accounting Principles (GAAP) in the United States or International Financial Reporting Standards (IFRS) globally (Kieso, et al, 2016).

Managerial accounting is “the provision of accounting information for a company’s internal users. More specifically, managerial accounting represents the firm’s internal accounting system designed to provide the necessary financial and non-financial information that helps company managers make the best possible decisions” (Mowen et al, 2018, p. 4). This involves “the process of collecting, analyzing, interpreting, and presenting financial and non-financial information to assist management in decision-making, planning, and control within an organization. Unlike financial accounting, which focuses on preparing standardized financial statements for external stakeholders, managerial accounting is internally focused and provides tailored information to support strategic and operational decisions” (xAI, Grok 4, 2025).

Financial management focuses on “strategic planning, organizing, directing, and controlling financial activities within an organization to achieve specific financial objectives. It involves the efficient and effective management of monetary resources to maximize value, ensure liquidity, and mitigate risks. Financial management encompasses a range of activities, including budgeting, forecasting, investment decisions, risk management, and the oversight of financial operations” (xAI, Grok 4, 2025).

This article introduces financial management.

Reader’s note: A finance calculator https://www.calculator.net/finance-calculator.html and financial calculators https://www.calculator.net/financial-calculator.html are available at calculator.net.

History

The origins of financial management extend into antiquity, beginning with the emergence of trade and resource allocation. For example, clay tablets dating to about 3000 BC were discovered recording transactions in early forms of accounting. The Code of Hammurabi dates to about 1750 BC describing early financial governance. In antiquity, from ancient Egypt to ancient China to classical Greece (and later the Roman Empire), similar archaeological discoveries have unearthed artifacts demonstrating civilizations engaging in early accounting and finance.

The globalism of the Renaissance and the Age of Exploration resulted in more advanced financial systems and finally the first stock exchange in Amsterdam in 1602 and the Bank of England in 1694.

The Industrial Revolution increased the scale of enterprises and capital requirements ushering in the Modern Era. Intellectuals began publishing their theories on economics with an aim toward strategic finance. Stock exchanges and financial markets were established around the world.

The 20th century brought institutionalization, specialization, the creation of powerful government regulatory agencies, and the professionalization of financial management. Modern intellectuals introduced new financial management theory; for example, Harry Markowitz’s risk-return optimization and the capital asset pricing model (CAPM). Modern globalism expanded standard financial management practices internationally. Computerization brought complex financial modeling and data analysis.

And finally, the beginning of the 21st century has brought new legislation and financial instruments such as blockchain, cryptocurrencies, algorithmic trading, etc (xAI, Grok 4, 2025).

Body

As stated, finance involves the study of evaluating investments and raising capital to fund them.

Titman et al. (2019) lists “the three basic questions addressed by the study of finance:

1. What long-term investments should the firm undertake? This area of finance is generally referred to as capital budgeting.

2. How should the firm raise money to fund these investments? The firm’s funding choices are generally referred to as capital structure decisions.

3. How can the firm best manage its cash flows as they arise in the day-to-day operations? This area of finance is generally referred to as working capital management (p. 36).”

The three common business types are:

1. The sole proprietorship which is owned by a single individual entitled to all of the profits and responsible for all of the debts. There is no separation between the business and the owner with respect to liability.

2. A partnership is composed of two or more people who co-own a business for profit. A co-owner may be a general partner involved in the firm’s day-to-day activities with the same liability that a sole proprietor has. Or, they may be a limited partner who’s invested in the business (i.e., silent partner) but not involved in running the business possessing a liability limited to the amount of their investment.

3. A corporation may be privately or publicly held. In either case, shares are issued and the owners are the shareholders (i.e., stockholders). Corporations legally function separately and apart from their owners. Owner liability is restricted to their investment in the corporation; corporations have continuity; and the corporate structure is better for raising capital.

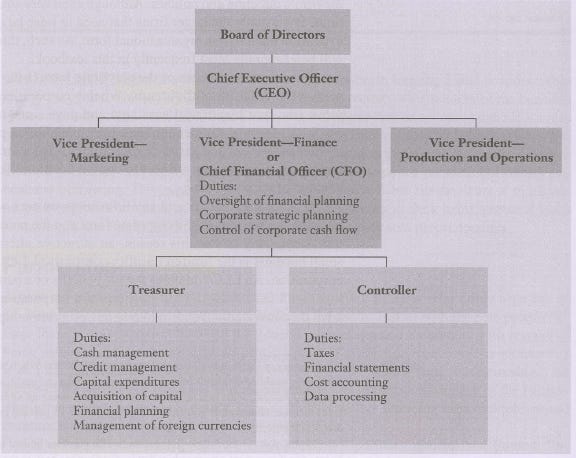

The following illustrates how finance fits into a corporation:

Financial managers (e.g., CFO, treasurer, controller, etc.) ultimately work for the owners of the corporation (e.g., shareholders, stockholders) to maximize their wealth within legal boundaries.

Borrowers, savers, investors, and institutions interact in financial marketplaces. These marketplaces include commercial banks, insurance companies, investment banks, investment companies, primary (for new securities) and secondary (for previously issued securities) securities markets, etc.

It is these security markets that bring investors and business together. The types of securities offered investors are debt securities and equity securities. Debt securities typically pay interest over a period of time to investors while equity securities (typically common or preferred stock) result in ownership of the corporation when purchased. Stock markets facilitate these transactions.

These represent the bulk of investor transactions; however, there are many other financial instruments available to investors besides in financial marketplaces.

In the United States, firms are required to adhere to Generally Accepted Accounting Principles (GAAP). GAAP are a "standardized set of accounting rules, standards, and procedures established to ensure consistency, transparency, and comparability in financial reporting within the United States... primarily issued by the Financial Accounting Standards Board (FASB) and provides a framework for preparing and presenting financial statements, ensuring that businesses follow uniform guidelines when reporting financial information" (xAI, Grok 4, 2025).

GAAP facilitates consistency, transparency, a principle-based approach, is mandatory, and covers core components (e.g. revenue recognition, balance sheet classification, expense recognition, etc.). Outside the U.S., the International Financial Report Standards (IFRS) is the framework most often found.

The analysis of financial statements are integral to assessing the state of an organization; it’s current performance, to monitor and control operations, and plan and forecast future performance. The most common are as follows:

1. Income statement (i.e. profit and loss statement): This “summarizes a company's revenues, expenses, and net income or loss over a specific period. Its primary purpose is to provide a clear picture of a company's financial performance, detailing how revenue is transformed into net income through various expenses and costs” (xAI, Grok 4, 2025).

Specifically, an income statement measures profitability, tracks revenue and expenses, supports decision-making, facilitates performance comparison, and ensures compliance.

2. Balance sheet: This “is a financial statement that provides a snapshot of a company's financial position at a specific point in time. It details the company's assets, liabilities, and shareholders' equity, offering a clear view of what the company owns, owes, and the residual value attributable to its owners” (xAI, Grok 4, 2025).

The balance sheet summarizes a company's financial position, assesses liquidity and solvency, supports decision-making, facilitates comparisons, and is needed for regulatory compliance.

3. Cash flow statement: This “is a financial statement that provides a detailed summary of a company's cash inflows and outflows over a specific period. It tracks the movement of cash and cash equivalents, offering insight into how a company generates and uses cash to meet its operational, investing, and financing needs” (xAI, Grok 4, 2025).

Specifically, a cash flow statement measures the movement of cash with respect to operating activities, investing activities, and financing activities. It assesses liquidity, compliments other financial statements (together financial statements provide a comprehensive view of a company's performance and liquidity), supports decision-making, and assists with transparency and compliance.

4. Statement of shareholder’s equity: This “is a financial report that outlines the changes in a company’s equity accounts over a specific period. It details the movements in shareholders' equity, which represents the residual interest in the company’s assets after deducting liabilities, providing insight into how equity is affected by various transactions and events” (xAI, Grok 4, 2025).

Specifically, a statement of shareholders' equity tracks changes in equity accounts (e.g., common stock, additional paid in capital, retained earnings, treasury stock, and accumulated other incomes [foreign currency translation, pension adjustments, etc.]); reflects financial activities, provides transparency to stakeholders, supports financial analysis, and assists with regulatory compliance.

In addition to financial statements, financial ratios are employed to "evaluate a company's financial performance, operational efficiency, and overall stability by comparing relationships between various financial statement items. They serve several critical purposes in financial analysis, enabling stakeholders to make informed decisions… They provide a standardized framework for stakeholders to interpret complex financial data efficiently and effectively." (xAI, Grok 4, 2025).

Despite limitations; financial ratios are used to assess performance, facilitate comparisons, evaluate financial health, support decision-making, identify trends and anomalies, and are used in setting benchmarks and goals. Examples include liquidity ratios, capital structure ratios, asset ratios, management efficiency ratios, probability ratios, market value ratios, etc.

Titman et al (2019, pp. 43-45) lists the five basic principles of finance as:

1. Money has a time value. The value of money changes over time.

2. There is a risk-return tradeoff. Additional risk requires additional return.

3. Cash flows are the source of value. The amount of cash which can be taken from a business.

4. Market prices reflect information. Investors respond to information when buying and selling.

5. Individuals respond to incentives. The principle of self-interest.

Financial managers compare benefits and costs in different time periods in manifold ways. They compound interest, time, and rates; and calculate the value of of money over time. Terms such as ordinary annuity, annuity due, amortized loan, etc. reflect this.

Financial managers calculate rates of return and risk in various ways within systematic and non-systematic contexts. They also need an understanding of markets/market portfolios and financial theories.

With respect to debt, debt securities provide value to lenders through interest payments on outstanding loan amounts and the repayment of loan balances. Both private and public debt markets exist. With respect to stock and dividends, common stock has no maturity date and common dividends have no minimum or maximum. Preferred stock is more complex but does not have a fixed maturity date. Preferred stock dividends are fixed; however, unlike common stock which may not even pay a dividend. There are various means by which corporations distribute cash. Capital gains is another. These are the profits realized from the sale or disposal of a capital asset when the sale price exceeds the asset’s original purchase price (or cost basis).

With respect to capital budgeting, as potentially profitability projects and investments are identified, key equations are used to assess their suitability. The three most important are the Net Present Value (NPV), Internal Rate of Return (IRR) and the payback period, respectively.

Incremental cash flows are evaluated, project cash flows for expansion are calculated, comparisons are made. Risk is assessed using various analysis such as sensitivity, scenario, and simulation. An example are the various forms of break-even analysis. Financial managers also calculate capital costs and capital structure.

Financial planning occurs, which is a firm’s guide to the future. Financing requirements must be determined. Capital management must be correctly accomplished. So must risk management to the degree it is possible.

Also involved in financial management are international concerns. These include foreign exchange markets and currency exchange, interest rate and purchasing, and capital budgeting for direct foreign investment.

Conclusion

"Financial management is essential for ensuring the efficient allocation, utilization, and oversight of financial resources within an organization or for an individual’s personal finances. It encompasses planning, organizing, directing, and controlling financial activities to achieve specific objectives, such as profitability, stability, and growth. Below is a detailed explanation of why financial management is necessary, presented in a formal, structured, and concise manner, adhering to your preference for clear and professional language" (xAI, Grok 4, 2025).

When financial management is done right; it optimizes resource allocation, ensures financial stability, supports strategic decision-making, manages risks, enhances profitability and value creation, ensures compliance and accountability, facilitates growth and expansion, assists with future planning, and improves stakeholder confidence.

As this is but a brief introduction; a recent edition of Titman, et al’s Financial Management is suggested for understanding the content of this subject while the latest edition of Schaum's Outline of Financial Management (with answers) is recommended to work through financial management problems for competency.

Bibliography:

Benedict, A., & Elliott, B. (2011). Financial accounting: an introduction (2nd ed.). Pearson.

Britton, A., & Waterston, C. (2006). Financial accounting (4th ed.). Prentice Hall.

Kieso, D. E., Weygandt, J. J., & Warfield, T. D. (2016). Intermediate Accounting (16th ed). Wiley.

Markowitz, H. (2008). Harry Markowitz selected works. World Scientific.

McCulloch, J. R. (1888). The works of David Ricardo. London.

Mitchell, R. E. (2014). A concise history of economists' assumptions about markets: from Adam Smith to Joseph Schumpeter. Praeger.

Phillips, F., Libby R., Libby, P. A., & Mackintosh, B. (2015). Fundamentals of financial accounting (4th ed.). McGraw-Hill.

Rich, J. S., Jones, J. P., Mowen, M. M., & Hansen D. R. (2010). Cornerstones of financial accounting. Cengage.

Shim, J. K., & Siegel, J. G. (2009). Schaum’s outlines of financial management. McGraw Hill.

Simko, P., Ferris, K., & Wallace, J. (2017). Financial accounting for executives & MBAs: texts and cases. Cambridge Business Publishers.

Smith, A. (1759). The theory of moral sentiments. London.

Smith, A. (1776). An inquiry into the nature and causes of the wealth of nations. London.

Stickney, C. P., Brown, P. R., & Wahlen, J. M. (2007). Financial reporting, financial statement analysis, and valuation: a strategic perspective (6th ed.). Thomson.

Titman, S., Keown, A. J., & Martin, J. D. (2019). Financial management: principles and applications (13th ed.). Pearson.

Weygandt, J. J., Kimmel, P. D., & Kieso, D. E. (2019). Financial accounting with international financial reporting standards (4th ed.). Wiley.

Wild, J., Kwok, W., Venkatesh, S., Shaw, K. W., & Chiappetta B. (2016). Fundamental accounting principles (2nd ed.). McGraw-Hill.

xAI. (2025). Grok (version 4) [DeepSearch]. https://grok.com/

Fair Use: Copyright Disclaimer Under Section 107 of the Copyright Act in 1976; Allowance is made for "Fair Use" for purposes such as criticism, comment, news reporting, teaching, scholarship, and research. Fair use is a use permitted by copyright statue that might otherwise be infringing. All rights and credit go directly to its rightful owners. No copyright infringement intended.

Copyright © 2025 Paul L. Pothier. All rights reserved.