This is article four in the Educational Business Series (EBS).

Suggested Prerequisites

Accounting is indispensable to people, organizations, societies and governments and the many fields which incorporate the discipline, including the subject of this introductory essay: managerial economics.

Also critical to managerial economics are specific identifiable formulas with a basis in various math disciplines (e.g. calculus, linear algebra, statistics and probability, optimization theory, game theory, econometrics, and differential equations) which generally are incorporated into research and statistics for the purpose of managerial economics.

A brief summary of each discipline:

1. Financial accounting. “Financial accounting is a branch of accounting that focuses on the systematic recording, summarizing, and reporting of an organization's financial transactions in accordance with established standards and regulations. It primarily serves external stakeholders, such as investors, creditors, regulators, and tax authorities, by providing transparent and standardized financial information about the organization’s performance and financial position” (xAI, Grok 3, 2025).

2. Management accounting. “Management accounting involves the preparation and analysis of financial and non-financial information to support internal decision-making, planning, and control within an organization. Unlike financial accounting, which focuses on external reporting and compliance with standards such as GAAP or IFRS, management accounting is tailored to the needs of managers and is not subject to regulatory requirements. It provides insights to optimize operations, allocate resources, and achieve strategic objectives” (xAI, Grok 3, 2025).

3. Research and statistics. “The role of research and statistics in this field [i.e. managerial economics] is critical, as they provide the empirical foundation for analyzing data, testing economic theories, and optimizing managerial decisions” (xAI, Grok 3, 2025).

4. Managerial economics. “Managerial economics is a branch of economics that applies economic theories, principles, and analytical tools to business decision-making. It bridges the gap between economic theory and practical management, enabling managers to make informed decisions to achieve organizational objectives, such as profit maximization, cost minimization, or market competitiveness” (xAI, Grok 3, 2025).

Managerial Economics – Historical Information

Managerial economics emerged as a distinct field in the late 1940s and early 1950s when economics began to be systematically applied to business. In 1951, Joel Dean released Managerial Economics introducing tools that managers could apply to business such as "demand analysis, cost theory, and pricing strategies." "His work marked the formal recognition of managerial economics as a field, bridging the gap between theoretical economics and real-world business applications" (xAI, Grok 3, 2025).

In the preface of his innovative book, Dean (1951) stated the "purpose of this book is to show how economic analysis can be used in formulating business policies... In developing an economic approach to executive decisions, this book draws upon economic analysis for the concepts of demand, cost, profit, competition, and so on..." (p. vii).

The field expanded in the 1960s and 1970s. William J. Baumol "proposed the sales maximization hypothesis, suggesting that organizations often prioritize revenue growth over pure profit maximization—a departure from traditional economic assumptions. This theory provided a more nuanced understanding of business behavior." Oliver Williamson published "work on transaction cost economics" exploring "how organizations decide between in-house production and outsourcing" (xAI, Grok 3, 2025).

Advanced tools and sophisticated methodologies came into being during the 1980s and 1990s. For example, "game theory emerged as a key tool for analyzing competitive strategies and interactions between organizations, while econometrics enabled managers to leverage statistical data for forecasting and decision-making. Additionally, insights from behavioral economics started to influence the field, offering explanations for how psychological factors affect consumer and managerial choices" (xAI, Grok 3, 2025).

Presently, managerial economics has evolved into "an essential discipline for modern business management" blending together multiple academic disciplines such as microeconomics, statistics and research, and much more from other fields. (xAI, Grok 3, 2025).

Managerial Economics

Truett & Truett (2004, p.3) state that the central themes of managerial economics are:

1. Identifying problems and opportunities.

2. Analyzing alternatives from which choices can be made.

3. Making choices that are best from the standpoint of the organization.

They articulate these central themes in ten economic principles for managers as follows:

1. The role of Managers is to make decisions.

2. Decisions are always among alternatives.

3. Decision alternatives always have costs and benefits.

4. The anticipated objective of management is to increase the organization’s value.

5. The organization’s value is measured by its expected profits.

6. The organization’s sales revenue depends on demand for its products/services.

7. The organization must minimize cost for each level of change.

8. The organization must develop a strategy consistent with its market.

9. The organization’s growth depends on rational investment decisions.

10. Successful organizations deal rationally and ethically with laws and regulations.

These principles should guide managers in their work and decision-making.

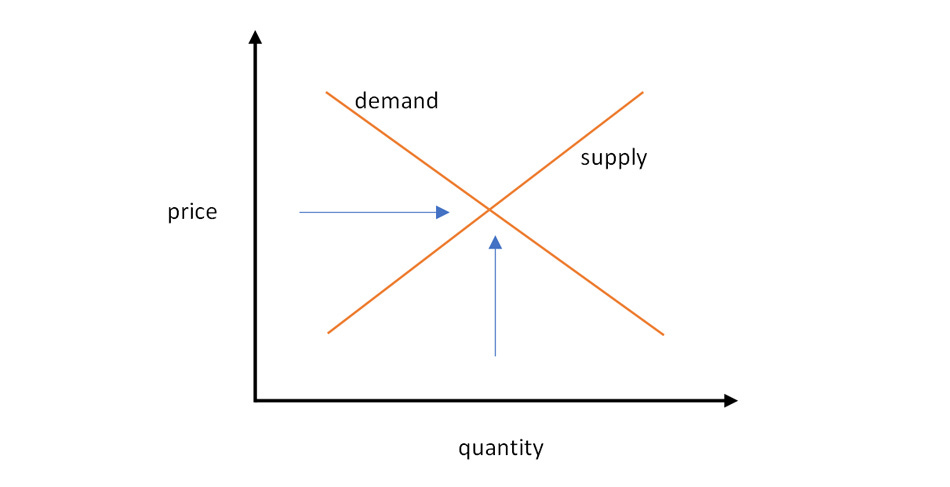

And, it needs to be stated that organizational decision-makers engaging in managerial economics should have a working competency in basic demand and supply analysis.

A critical factor for organization revenue is the demand for its products/services. Understanding the demand function means knowing the demand for quantity over time and how that is affected by pricing, consumer, and advertising variables which can be plotted using a demand curve that is associated with total revenue, average revenue, and marginal revenue. Elasticity is examined. Elasticity measures how sensitive economic variables are to each other as a quantification of responsiveness (Truett & Truett, 2004, pp.33-85).

Consumer behavior is considered. Methods to quantify this focus on utility (e.g. cardinal utility approach, ordinal utility, marginal rate of substitution, and consumer equilibrium).

A key concern is the information needed to make decisions for operations to increase revenue, maximize profit, and expand their market. “Obviously, the more closely the organization can estimate demand conditions for its product, the more likely it is to determine correctly its profit-maximizing rate of output and price, or whether to produce a particular product at all” (Truett & Truett, 2004, p. 98).

Market research (e.g. surveying, experimentation, etc.) is employed, along with demand estimation with regression analysis, to predict future demand for a product or service.

Linear regression analysis is used to examine the relationship between a dependent variable and one or more independent variables for predicting outcomes and understanding relationships between variables.

Organizations need accurate revenue data and such tools to estimate an organization’s demand function (among other things). Then, they can engage in long-run and short-run economic forecasting.

“Forecasting refers to the process of analyzing available information regarding economic variables and relationships and then predicting the future values of certain variables of interest to the organization or economic policymakers” (Truett & Truett, 2004, p. 142).

Two types of data are used in economic forecasting:

1. Time series data: sequences of data points from time intervals.

2. Cross-sectional data: data for a specific point in time.

Factors which affect economic variables can be classified as trend factors, seasonal factors, cyclical factors, and other factors. Five common forecasting techniques used in economics are trend analysis, ARIMA models, barometric forecasting, surveys, and econometric models. Keep in mind that such forecasting do not result in completely accurate forecasts; however, when used correctly much can be learned to aid in decision-making.

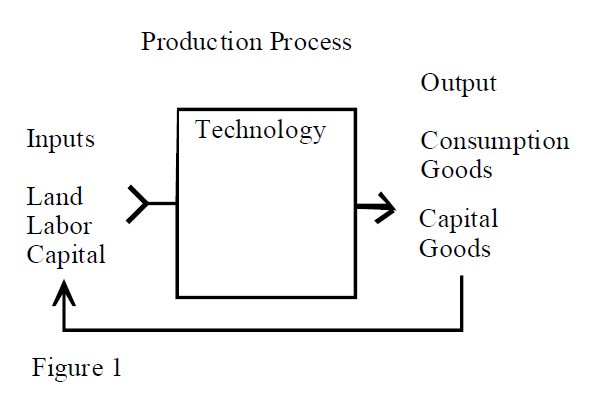

The two main factors of concern to for-profit organizations are revenue and cost. Production analysis, which examines the processes for producing goods and services to maximize revenue and minimize costs, is a natural result of these concerns (Truett & Truett, 2004, pp. 176-219).

Central to production analysis is cost (e.g. cost of production). Knowledgeable managers understand that the level of cost relative to revenue determines the organization’s overall profitability. There are many types of costs (explicit/historical and implicit/opportunity), of course, including “historical costs, opportunity costs, fixed costs, variable costs, incremental costs, private costs, and social costs” (Truett & Truett, 2004, p. 223).

Though information about costs may be lacking, fixed costs and how costs vary with respect to output should be understood. Managerial economics employs various tools to aid in cost analysis in the long-run and short-run. Of course, products and services that people desire should be produced, marketed well, and priced correctly.

The next feature of managerial economics is profit analysis which uses tools to measure the difference between revenue and cost with a focus on examining how to maximize the difference (i.e. profit maximization). Profit analysis is critical to decision makers looking to improve profitability.

Another important mathematical tool is linear programming which is used for optimizing problems with a linear objective function and linear constraints that are in the form of inequalities.

Also of great interest is an understanding of market structures with respect to input price determination:

1. Where both the firms buying the input and the suppliers of the input are perfectly competitive.

2. Where there is only one buyer of the input (monopsony) but the suppliers view the market as perfectly competitive.

3. Where there is only one buyer and one seller of the input (bilateral monopoly).

“In the case of a perfectly competitive market for an input, the market price and equilibrium quantity are determined by market demand and supply. In the case of a monopsonistic input market, the market price and equilibrium quantity are determined by the quantity of the input utilized by the one buyer of the input… Finally, in the case of bilateral monopoly, the market price and equilibrium quantity of an input are determined through a bargaining process… For a firm interested in employing the profit-maximizing quantity of a variable input: Employ the input until its marginal revenue product equals its marginal cost” (Truett & Truett, 2004, p. 531-532).

Theoretical models which aid organizations in self-analysis include examinations of perfect competition and monopoly; monopolistic competition and oligopoly; game theory and strategy; etc. Multiple products, types of markets, and pricing strategies must be considered.

And with respect to the “decision rule that a firm must follow in order to determine the quantity of a variable input that it should utilize to maximize profit: Employ a variable input, input L, up to the point where MRPL = MCL. If PL is constant for all levels of input L employed by the organization, MCL = PL and the firm should utilize the input until MRPL = PL” (Truett & Truett, 2004, p. 531; "Marginal Product of Labor: MPL, MRPL and Profit Maximization," 2025).

Multiple variable inputs and material costs need to be considered.

Managerial economics also focuses on management’s analysis of investment opportunities (e.g. capital budgeting), which may include new pursuits. Methods are used to estimate costs, revenues, compounding and discounting, risk and risk adjustment, etc.

Finally, the organization must factor the public sector (i.e. public sector analysis) and the legal and regulatory environment.

Conclusion

“Managerial economics serves as a vital discipline that integrates microeconomic principles with practical business decision-making. It provides managers with a structured framework to address complex business challenges by applying tools such as demand analysis, cost analysis, pricing strategies, and an understanding of market structures. These concepts enable firms to allocate scarce resources efficiently, optimize operations, and maximize profitability.

In practice, managerial economics empowers managers to make informed, data-driven decisions that enhance business performance. For example, demand forecasting helps predict customer behavior, while cost analysis ensures resources are used effectively. Pricing strategies and insights into market dynamics allow firms to remain competitive in diverse and evolving markets. Despite challenges such as limited data or the unpredictability of real-world conditions, the benefits (e.g. improved efficiency, better resource allocation, and strategic planning) far outweigh the limitations.

Ultimately, managerial economics is indispensable in today’s complex business environment. It equips managers with the analytical tools needed to navigate uncertainty, align decisions with organizational goals, and maintain a competitive edge. By bridging economic theory and managerial practice, it plays a crucial role in driving organizational success and sustainability” (xAI, Grok 3, 2025).

This introduction to managerial economics merely skims the surface, certainly with respect to the depth of the mathematical and statistical formulas the discipline employs. However, it should suffice to rapidly introduce the layperson to the theme of the subject, which is the purpose of this article.

Reader’s note:

This 12-minute presentation from ThinkEduca’s “Leader’s Talk” series is helpful to those being introduced to managerial economics for the first time. Click here to watch the video on YouTube.

Afterwards, to gain a deeper understanding, consider viewing a scholarly lecture series on the topic of managerial economics such as this one by Chris Azevedo (professor of economics at the University of Central Missouri):

https://www.youtube.com/playlist?list=PLTjEimbqDkpDSuxBF8M_AJCVxhgkBXAZN

Bibliography:

Baumol, W. J. (1977). Economic theory and operations analysis. Prentice-Hall.

Baumol, W. J., & Blinder, A. S. (2009). Economics: principles & policy. South-Western Cengage Learning.

Baye, M. R. (2000). Managerial economics & business strategy. McGraw-Hill.

Benedict, A. (2011). Financial accounting: an introduction. Pearson.

Brewer, P. C., Garrison, R. H., & Noreen, E. (2023). Managerial accounting. McGraw-Hill.

Dean, J. (1951). Managerial economics. Prentice-Hall.

Frank, R. H., & Bernanke, B. S. (2007). Principles of macroeconomics. McGraw-Hill.

Gillespie, A. (2016). Foundations of economics. Oxford University Press.

Hansen, D. R., & Mowen, M. M. (2005). Management accounting. Thomson.

Jehle, G. A., & Reny P. J. (2001). Advanced microeconomic theory. Addison-Wesley.

Mankiw, N. G., & Ball, L. M. (2011). Macroeconomics and the financial system. Worth Publishers.

Mansfield, E., & Yohe, G. (2004). Microeconomics: theory/applications. W. W. Norton & Company.

Marginal product of labor: MPL, MRPL and profit maximization. (2025, May 1). In Wikipedia, The Free Encyclopedia. https://en.wikipedia.org/wiki/Marginal_product_of_labor#MPL,_MRPL_and_profit_maximization

Petersen, C. H., & Lewis C. W. (1999). Managerial economics. Prentice-Hall.

Phillips, F., Libby, R., Libby, P. A., & MacKintosh, B. (2015). Fundamentals of financial accounting. McGraw-Hill.

Prince, J. T., & Baye, M. R. (2021). Managerial economics and business strategy (9th ed.). McGraw Hill.

Salvatore, D. (2012). Principles of microeconomics. Oxford University Press.

Sikdar, S. (2006). Principles of macroeconomics. Oxford University Press.

Simko, P. J., Ferris, K. R., & Wallace, J. S. (2017). Financial accounting for executives & MBAs. Cambridge Business Publishers.

Spiceland, D. J., Thomas, W., & Herrmann, D. (2022). Financial accounting. McGraw-Hill.

Stickney, C. P., Brown, P. R., & Wahlen, J. M. (2007). Financial reporting, financial statement analysis, and valuation: a strategic perspective. Thomson.

Thomas III, L. G. (1986). The economics of strategic planning: essays in honor of Joel Dean. Lexington Books.

Titman, S., Keown, A., & Martin, J. (2017). Financial management: principles and applications. Pearson.

Truett, L. J., & Truett, D. B. (2004). Managerial economics: analysis, problems, cases. Wiley.

Weygandt, J. J., Kimmel, P. D., & Kieso, D. E. (2019). Financial accounting: with international financial reporting standards. Wiley.

Williamson, O. E. (1975). Markets and hierarchies: analysis and antitrust implications. The Free Press.

xAI. (2025). Grok (version 3) [DeepSearch]. https://grok.com/

Fair Use: Copyright Disclaimer Under Section 107 of the Copyright Act in 1976; Allowance is made for "Fair Use" for purposes such as criticism, comment, news reporting, teaching, scholarship, and research. Fair use is a use permitted by copyright statue that might otherwise be infringing. All rights and credit go directly to its rightful owners. No copyright infringement intended.

Copyright © 2025 Paul L. Pothier. All rights reserved.